The implementation of the Nigerian Tax Act and the Nigerian Tax Administration Act will commence as scheduled on January 1, 2026, Mr Taiwo Oyedele, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has said.

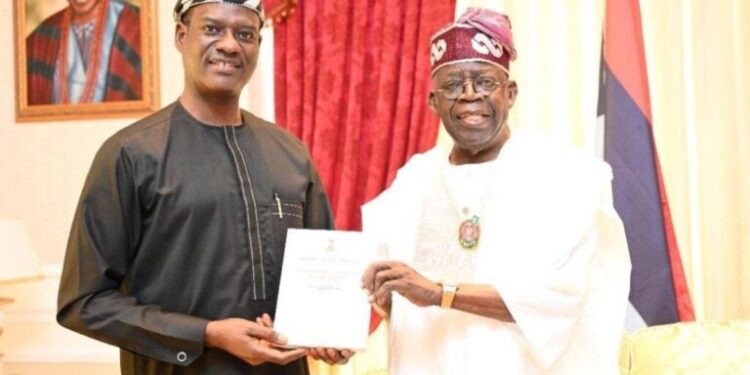

Oyedele stated this on Friday shortly after presenting the new tax acts to President Bila Tinubu in his Bourdillon Road residence in Lagos.

Oyedele presented the tax acts to President Tinubu in company with the Chairman of the Nigerian Revenue Service (NRS), Zacch Adedeji, and the Chairman of the National Tax Policy Implementation Committee, Joseph Tegbe.

He told journalists that two of the four landmark tax reform laws signed earlier this year are already in force — the Nigerian Revenue Service (Establishment) Act and the Joint Revenue Service (Establishment) Act, effective June 26, 2025.

Oyedele explained that the remaining two laws, the Nigerian Tax Act and the Nigerian Tax Administration Act, will take effect as scheduled on January 1, 2026.

According to him, the tax reforms are pro-people and designed to reduce the tax burden on ordinary Nigerians and stimulate economic growth.

“Bottom 98 per cent of workers will see either no PAYE tax or lower taxes.

“Small businesses, 97 per cent of them, will be exempted from Corporate Income Tax, VAT, and Withholding Tax, while large businesses will experience a reduction in tax obligations,” Oyedele explained.

He explained that the staggered rollout of the laws was intentional, allowing newly created institutions like the Office of the Tax Ombudsman to become operational ahead of full implementation.

The focus, he said, is on long-term economic growth and improved tax compliance, rather than immediate revenue generation.

On allegations of alterations to the laws, Oyedele said the Federal Government welcomes the National Assembly’s review and remains open to legislative engagement if necessary.

Meanwhile, the National Assembly said its decision to address public concerns over the legislative process and the publication of the four tax laws in the Official Gazette is strictly within its constitutional and statutory mandate.

The assembly said an internal review is underway to ensure clarity, accuracy, and sanctity of the legislative record, stressing that the process does not imply any defect in legislative authority.

The National Assembly appealed for public restraint, reaffirming its commitment to transparency, accountability, and due process while assuring stakeholders that further information will be provided as necessary.

The tax reforms are expected to benefit millions of Nigerian workers and small businesses, promote fairness in the tax system, and contribute to sustainable public finances in the long term.

(vitalnewsngr.com)