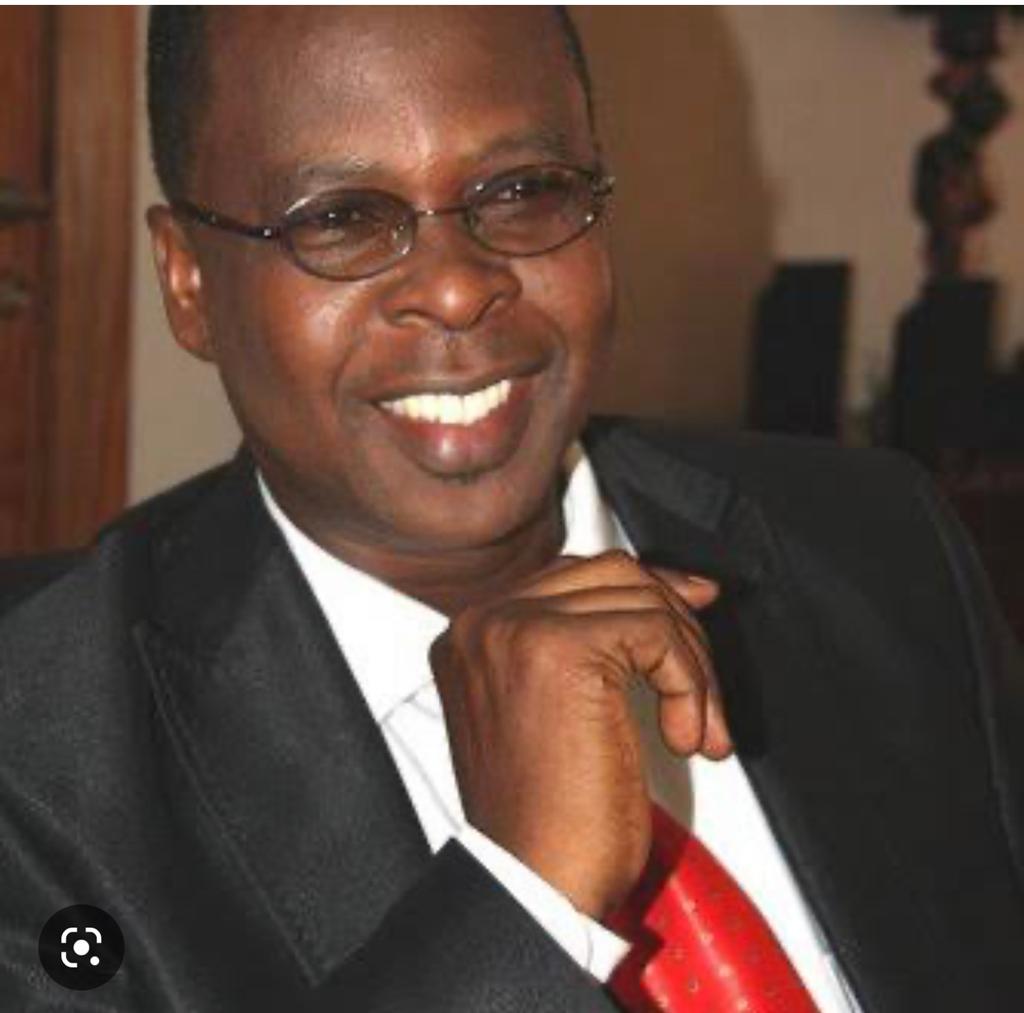

The governor of the Central Bank of Nigeria (CBN), Mr Olayemi Cardoso, said fourteen financial banks in Nigeria have so far met their 2026 recapitalisation deadline set for all commercial banks in the country.

The stipulated new minimum capital requirement for commercial banks is N500 billion for international authorization, N200 billion for national authorization, and N50 billion for regional authorization.

Cardoso spoke on Tuesday in a briefing after the 302nd Monetary Policy Committee meeting in Abuja.

He said the Nigerian banking sector remained strong and resilient.

Cardoso, however, did not mention the names of the banks that have met CBN’s recapitalisation requirements.

“About 14 banks have met the regulatory capital requirements,” he said.

During the 301st MPC meeting in July 2025, Cardoso had said eight banks have met CBN’s minimum capital requirements.

There are reports that banks include Zenith Bank, Access Bank, Guarantee Trust Bank, Stanbic,WEMA Bank, United Bank of Africa, and others have met their respective minimum capital requirements.

The stipulated new minimum capital requirement for commercial banks is N500 billion for international authorization, N200 billion for national authorization, and N50 billion for regional authorization.

These new requirements were announced in March 2024 and are to be met by March 31, 2026.

Banks have until March 31, 2026,to meet the new capital thresholds.

(vitalnewsngr.com)