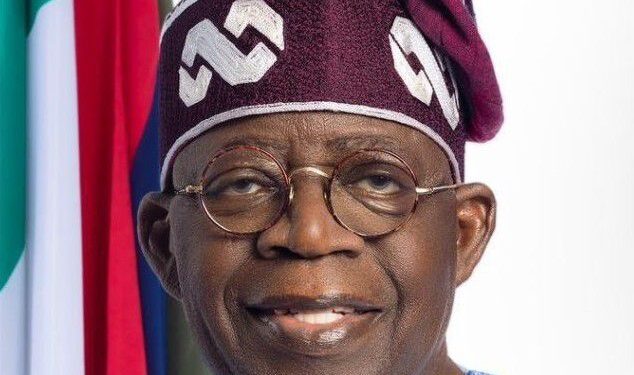

The Tinubu Media Support Group (TMSG) says Nigeria’s foreign reserve, which hit an eight-year high of $46.7 billion in just two years, has again proven that President Bola Tinubu came fully prepared for the job.

The group stated this in a

statement signed and issued on Wednesday by its Chairman, Emeka Nwankpa, and Secretary Dapo Okubanjo

TMSG described the steady increase in reserves as a validation of the appropriateness of the economic policies introduced by the administration since it assumed office.

The statement reads: “As of when President Bola Tinubu assumed office, Nigeria’s foreign reserves stood at $35 billion but within the third quarter of the year-which was the administration’s first quarter, it dropped to $33 billion at a time the country was battling the effects of the twin policies of removal of fuel subsidy and harmonization of the foreign exchange markets.

“For some sceptics, this drop was a sign that the administration was floundering, but they failed to realise that the initial decline in the foreign reserves was primarily as a result of debt repayments and other standard financial obligations inherited from the former Muhammadu Buhari administration.

“It was gratifying that the Tinubu administration began to prove naysayers wrong from July 2024 with foreign reserves bouncing back to the pre-Tinubu figure of $35 billion.

“So technically, the upward swing of the reserves has been on for about 18 months during which it witnessed alternating months of depletion and recovery, due to oil-price swings, remittance flows, and foreign exchange reforms.

“We dare say that strong non-oil exports, higher oil receipts from improving daily crude production, and renewed investors’ confidence have created a conducive atmosphere for growth in the country’s foreign reserves to the extent of hitting an eight-year high of approximately $46.7 billion as of mid-November 2025.

“We also acknowledge that this upward trajectory is supported by a tighter monetary regime by the Central Bank of Nigeria (CBN), which has stabilised the naira and boosted the country’s external buffers.

“Today, we make bold to say that the foreign reserves are at a level where they can easily provide substantial coverage for imports and also strengthen Nigeria’s ability to meet its international obligations having exceeded the internationally recommended benchmark.

“For us, this is not just a stroke of luck.

“It is a reflection that President Tinubu came into the job prepared.

“And this is why the economy is also continually receiving improving sovereign credit ratings from global rating agencies, the latest being from S&P Global Ratings, which upgraded Nigeria’s credit rating outlook from positive to stable at “B-/B”.

“For the avoidance of doubt, this is Nigeria’s strongest rating by the credit rating agency since 2015 when it handed a BB-rating.”

TMSG added that with foreign reserves continually attaining new heights in the midst of sound economic policies, it is a matter of time for Nigerians to begin to feel the full effect of President Tinubu’s skilful handling of the economy. (vitalnewsngr.com)