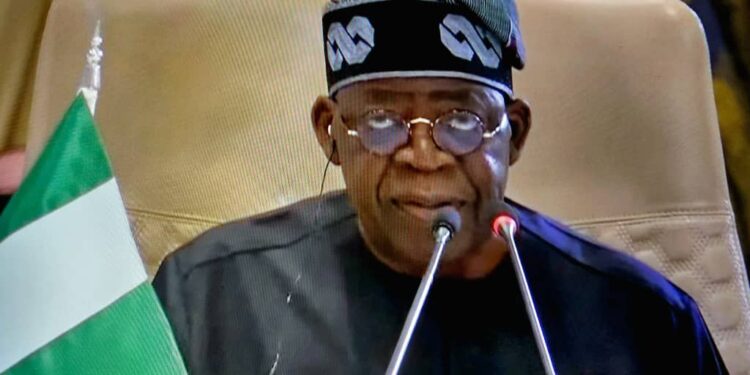

The Independent Media and Policy Initiative (IMPI), a Think Tank, says the proposed tax reforms of President Bola Tinubu administration will ensure inclusive growth for the benefit of all Nigerians.

The Chairman of IMPI, Dr Omoniyi Akinsiju, stated this at a press conference in Abuja on Saturday.

He said aside easing pains of majority of Nigerians, freeing funds for enterprises to grow, stimulating job creation, and granting greater latitude for manufacturers, the Nigeria’s tax reform is designed to set the country as one of the lowest tax-to-GDP ratios in Africa.

He commended the acknowledgement of the low purchasing power of the larger percentage of the estimated 220 million population of Nigeria.

Akinsiju said : “We see in the tax bills that the authors have provided circular money movements by allowing for more money to be domiciliated in the hands of ordinary citizens as reflected in the capital gain provision of the bills and exemption from personal income tax payment.”

“In addition, the gains accruing to an individual are exempt from tax in respect of the disposal of, or an interest in — a dwelling-house or part of such dwelling-house; and land, other than land used for commercial purposes, immediately adjoining the dwelling house up to a maximum of one acre.

“In addition, a gain accruing on the disposal of an asset, which is tangible movable property being personal chattels of an individual shall not be a chargeable gain if the total amount or value of the consideration for the disposal does not in a period of assessment exceed N50,000,000 or three times the annual national minimum wage, whichever is higher.’’

He explained that this section of the tax bills is an enabler of increased disposable income and that rather than the government taking a share of the money or assets sold, the government allows the citizen to spend his or her money the best way he or she so desires.

“When this is combined with the progressive personal income tax system and tax relief for low-income earners with the exemption of those earning incomes below N800,000.00 from personal income tax, we can safely assert that manufacturers of fast-moving consumer goods will see a huge difference in aggregate demand for their respective products.

“This has further positive implications for business expansion, job creation, and increased standard of living, ‘’ Akinsiju said.

He said that the the authors of the tax bills had the bouquet of challenges facing the manufacturing sector in mind in conceptualising the dimensions of the tax bills as forms of mitigations against reduced profits or losses.

He noted that the critical manufacturing sector has been described to be under siege as it endures a cruel combination of high energy costs, foreign exchange scarcity, rising inflation, insecurity, stratospheric interest rates, high logistics costs and unsold inventories amounting to N350 billion during the same period.

“The bottom line effect of these collections of challenges is the erosion of profit or, sometimes, actual losses on investment,’’ he explained.

Akinsiju further explained that companies operators or owners were now saved from paying on losses while small companies, defined as having annual gross turnover of less than N50 million, will now pay zero percent tax.

“About 43 million registered companies are said to fall into this category of small companies.

“The zero tax payment is the equivalent of a fiscal elixir that enables the companies to weather the inclement business environment while growing organically through reinvestment of income from their operations.

“This is usually the trajectory of small companies that soon become multinationals in business history.

“For other categories of companies, those with an annual turnover of more than N50 million, the tax bills configured are scheduled reduction of tax payment thresholds by reducing company income tax (CIT) payments from the current 30 per cent to 27.5 per cent in the 2025 year of assessment and further reduction to 25 percent from the 2026 year of assessment.

“This graduated reduction in company income tax corresponds to a huge rebate on the operating costs of qualifying companies.

“This, ordinarily, is a loss of revenue to the government, but in the wisdom of the tax bill authors, the reduced CIT should be considered as a government payoff for the challenges encountered in the business process and to assuage profit that might have been lost.

“We qualify all these initiatives as enterprise development.’’

Referencing the gas tax credit granted by tax reforms, Akinsiju said that the submission regarding this tax credit is that the gas production sub-sector of the oil and gas sector of the economy will transform to a beehive of economic activity when the incentives are applied.

Commenting on the Value Added Tax (VAT) as captured in the bills, Akinsiju explained that a large chunk of the misgivings in some quarters stems from the proposed formula for sharing the 90 percent accruing to the sub-nationals from proceeds of Value Added Tax (VAT).

He explained that the sharing template of VAT based on population, equity and derivation as opportunity for state governments to activate value addition possibilities within the economy of their respective states.

“They should not allow any raw material, either of agricultural or solid minerals type, to leave their domain without any form of value addition, even if it is basic processing.

“This way, consumption is registered through value addition, and such states can lay claims to consumption-based derivation beside the general levels of consumption that may be ascribed to them.

“We are, therefore, of the view that states which are big on agriculture could do more to ensure that some value is added to their food products so that they can derive benefits from consumption tax, which essentially is what VAT is, and this is moreso that food items in their raw forms are not VATable or exempt from VAT.’’

Akinsiju explained that the misunderstanding here is based on the current tax regime where derivation is attributed to headquarters remittance.

But with the new Tax Administration Bills proposal, VAT would be attributed to the place of supply and consumption and not the place of remittance, which currently favours states where company headquarters are domiciled.

“In our analysis, we found that the ongoing controversy and contentions over the VAT derivation proposal are needless.

“We also believe that states that are not comfortable with the percentage allotted to derivation could table counter proposals at the forthcoming public hearing of the bills at the National Assembly.’’

He expressed dismay at the unwarranted controversy that had been spurned around the bills.

“We consider this a needless distraction from the economically redeeming attributes of the tax bills. ‘’

(vitalnewsngr.com)